Market Overview: 2022

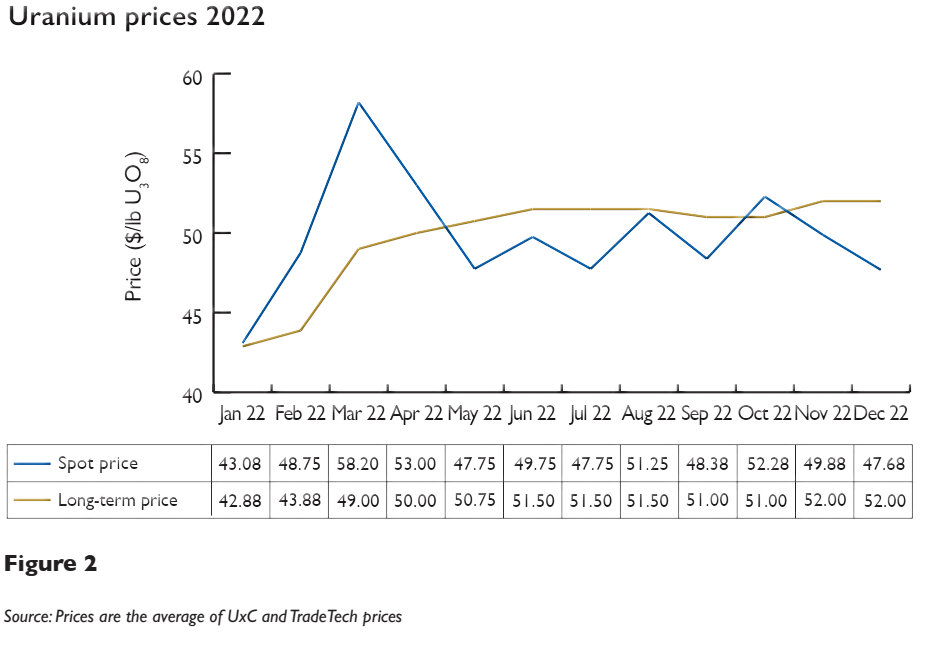

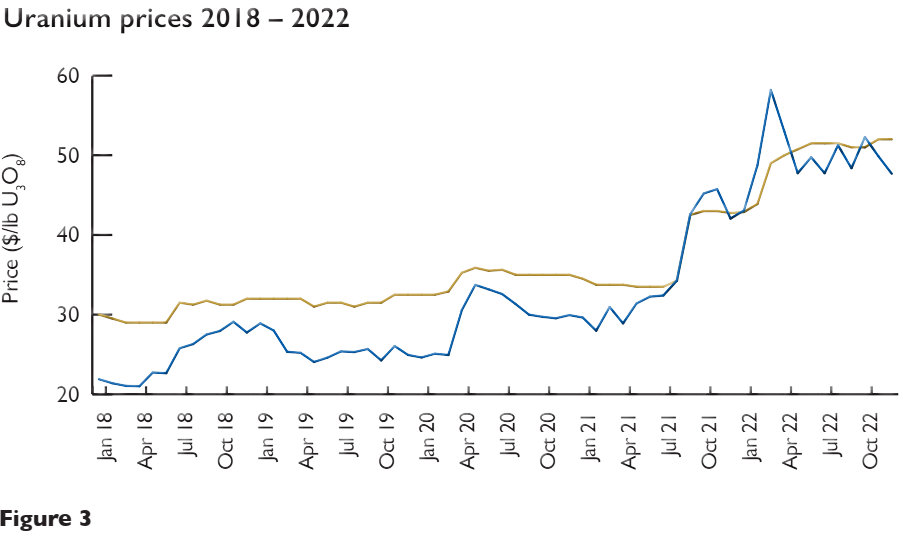

Significant impacts on the uranium market during 2022 came from geopolitical uncertainty. The unrest in Kazakhstan in January, and conflict between Russia and Ukraine from late February pushed the spot market price to a new height, with the daily spot price peaking at $63.75. However, as equity markets fell in late April, and some buyers shied away from purchases because of the high price, both spot volumes and prices fell dramatically in early May. Amid sustained lower activity, the spot price has been bound in a tighter trading range, oscillating around $50 throughout the second half of the year.

In 2022, total annual spot volumes reported by UxC were around 60.8 million pounds U3O8e, down 40% from last year. The spot market remains better balanced and generally thinner than compared with previous years.

With the sustained new higher spot price range, the term indicators finally started to improve as well towards the $50 per pound mark in April, achieving their highest level since 2014 and then holding firm at this level throughout 2022. The overall long-term contracting volume increased by 62% from 2021’s 70.5 million U3O8e to 2022’s 114 million, according to industry consultants UxC.

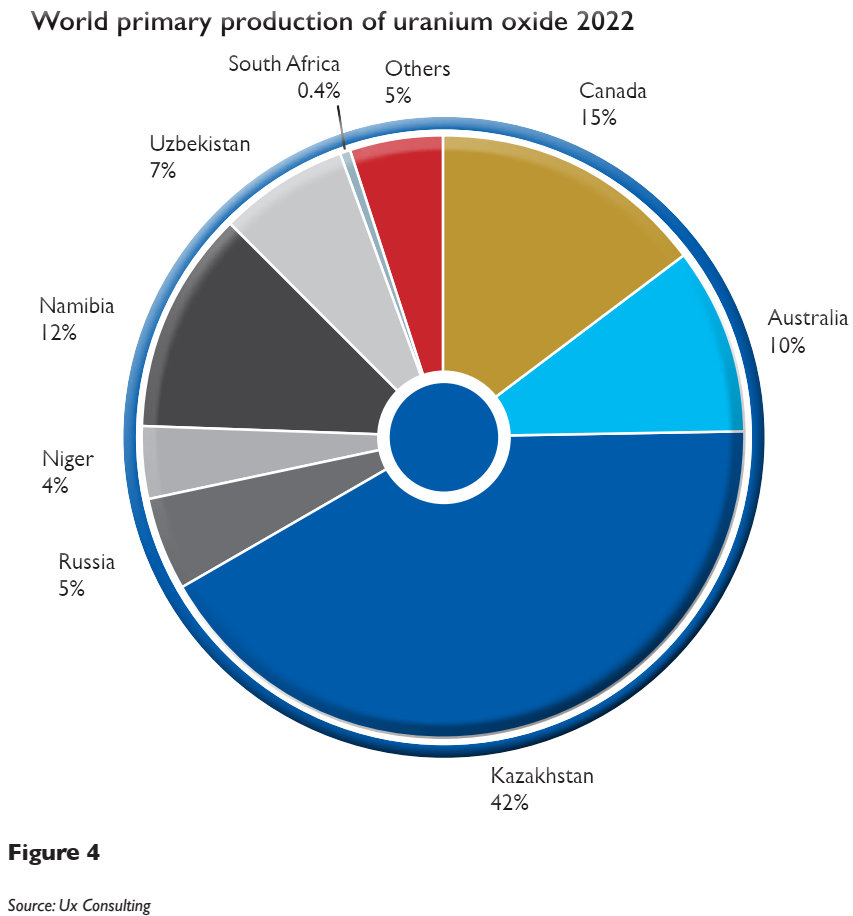

Namibia is now the third largest primary producer of U3O8 globally, after Kazakhstan, which continues to dominate the market from a supply side, and Canada. Rӧssing contributed approximately 4.4% to world primary production during 2022.

Market outlook

We remain optimistic about the role uranium will play in the future energy mix, with nuclear energy being able to provide a consistent baseload, as opposed to many other renewable energy sources.

According to UxC, there are now 432 operable units with roughly 389 GWe in capacity in 33 countries as of early December 2022. Under UxC’s base case scenario, it is anticipated that global nuclear energy will reach 34 countries with 441 reactors (~402 GWe net) in 2030, and 35 countries with 512 reactors (~489 GWe net) in 2035. In the forecast scenario, most of the growth by 2035 is anticipated to come from Asia (especially China); however, sizeable nuclear gains are also envisioned in Eastern Europe andAfrica and the Middle East.

With the ongoing geopolitical conflict between Russia and Ukraine, secondary demand from investors will remain a key factor in shaping the near-term market outlook. Over the long run, the status of Japan’s reactor restart and the growth of China’s nuclear programme will continue to affect the global nuclear fuel markets. On the supply side, as primary production and secondary supplies rebalance with market demand, improved market conditions will contribute to sustainable upward price momentum in the mid-2020s.

Marketing our product

In 2022, Rössing produced 5.9 million pounds U3O8, but only sold 5.7 million pounds U3O8. A total of 2.6 million pounds were shipped to western converters and sold to customers in North America, Asia (excluding China) and Europe, Middle East and Africa (“EMEA”). A total of 1.3 million pounds were shipped and sold to China. An additional 1.8 million pounds were sold to non-utility customers (traders and funds) on the spot market, capitalising on the sudden price spike during the year. Rössing continued to benefit from the contractual sales prices in its contract portfolio.

While the operation has boosted its resilience through various capital projects to ensure its ability to deliver on contractual obligations, our marketing approach has also adopted an appropriate allocation between future contractual and spot exposure to cover at least until 2026. The marketing team will further strengthen the communication with potential buyers of uranium and try to commit more sales on the market, adding to the longer-term sustainability of the operation, beyond 2026.